Strategic research for Office Timeline

TL;DR

Study Overview:

The primary scope of this study was to identify future product directions for Office Timeline Add-in and Office Timeline Online and triangulate existing quantitative data to guide long-term product roadmap.

The scope was achieved by conducting comprehensive competitor research and analysis of market trends, market landscape, and internal capabilities to develop effective strategies; it also involved performing an analysis of existing survey data on “next feature” research conducted through Appzi (in-product prompt surveys) and Typeform for Office Timeline Online.

Outcomes:

The research resulted in a set of strategic recommendations that directly informed the long-term product roadmap for both Office Timeline Add-in and Office Timeline Online. By triangulating competitor insights, market trends, and internal capabilities with quantitative user feedback from Appzi and Typeform surveys, the study identified high-potential product directions aligned with user needs and business goals. The recommendations were also assessed throughout Q4 of 2023 and Q1 of 2024 against a set of measurable success criteria, compiled for this specific purpose.

Research objectives

Overall goal: Identify actionable product opportunities and long-term strategic direction for both OTL (Office Timeline Add-in) and OTO (Web app).

Research objectives

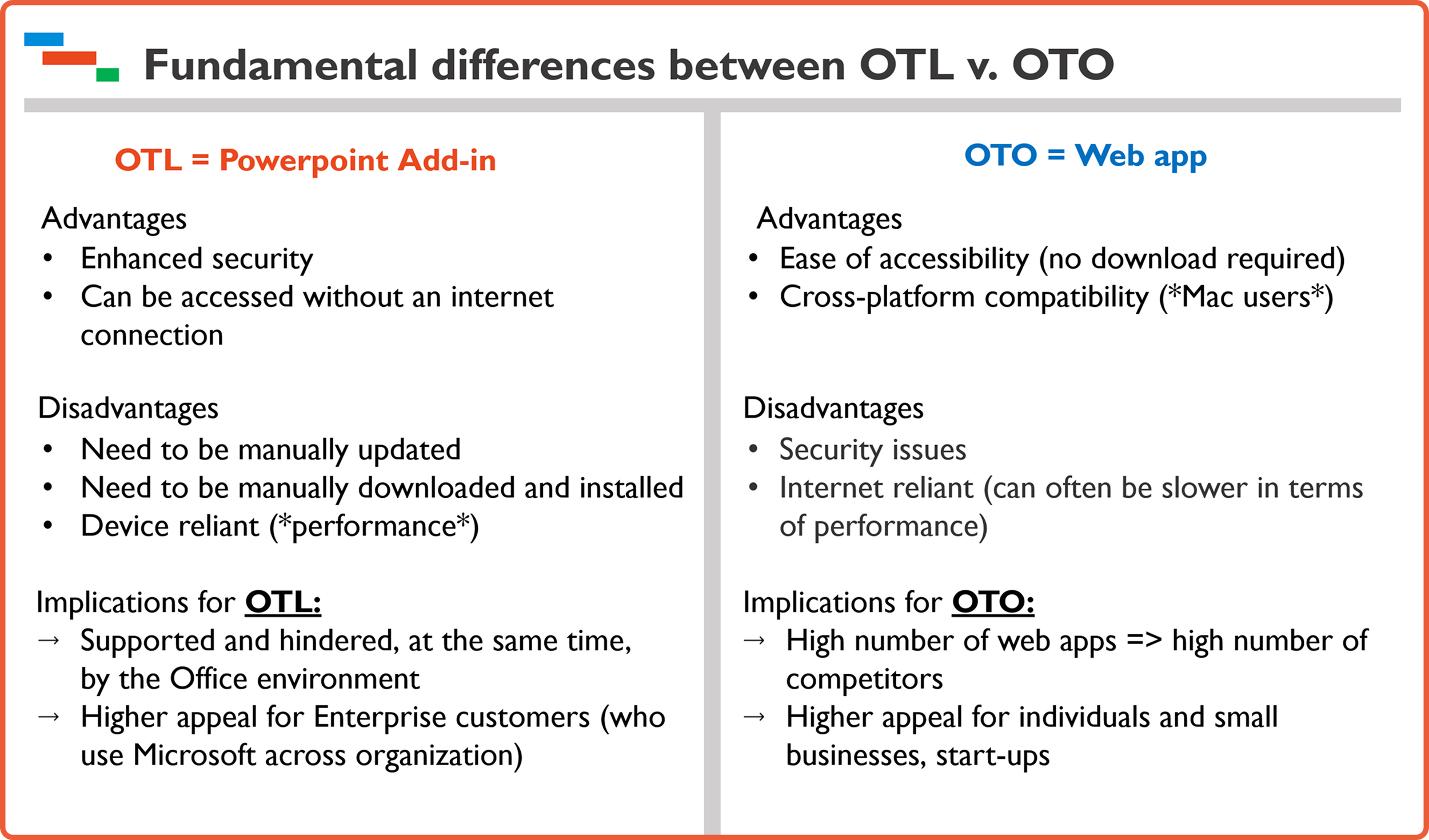

Review product positioning differences between OTL and OTO.

Map out competitive features and market gaps.

Analyze user feedback (Appzi, Typeform).

Highlight trends relevant to future planning.

Methodology

Research methods: The research objectives were achieved through a combination of targeted secondary research and in-depth analysis of existing quantitative survey data. Leveraging prior primary research enabled a fast yet comprehensive synthesis of insights, ensuring both efficiency and depth in the decision-making process.

Timeline: The entire research study took three weeks to compile, it was done in Q3 of 2023.

Here is a breakdown of research tasks:

Product positioning: Reviewed key differences between OTL and OTO as to understand how we could better position the two in the competitive market.

Competitor Analysis: Reviewed capabilities of key competitors for both OTL and OTO, taking into account desktop vs web environments (e.g., Think-cell, OnePager, Vizzlo, GanttPro, Preceden).

Market Analysis: Investigated user segments, trends, and emerging demands.

Survey Analysis: Analyzed existing Typeform (215 responses - “What is the most important feature that we are missing) and Appzi (931 responses) to extract top “missing features“ and top friction items.

VoC Review: Cleaned and analyzed 970+ lines of Appzi feedback using a tagging model (confidence 50–95%); responses were segmented into bugs, improvement ideas, and feature gaps.

Triangulation: Combined all data sources - competitor & market data, user feedback - to extract short-term wins and long-term opportunities for both products.

1. Product positioning insights - OTL vs. OTO

1. Distinct Target Segments

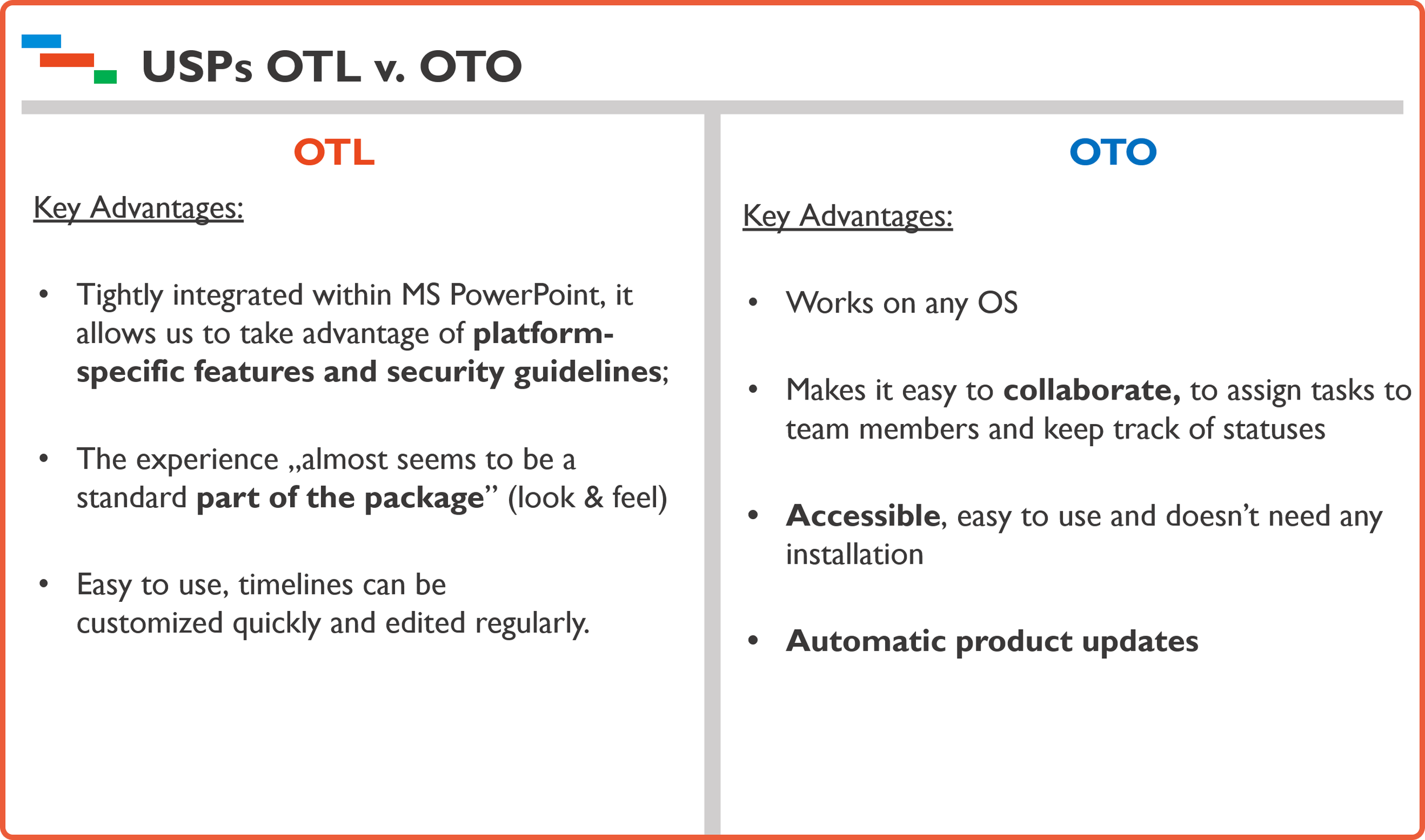

OTL is best positioned for enterprise and corporate environments, particularly those standardized on Microsoft Office; positioning cue: Emphasize security, compliance, and deep PowerPoint integration.

OTO naturally appeals to individuals, freelancers, small teams, and cross-platform users; positioning cue: Emphasize accessibility, ease of use, and collaboration potential.

2. Environment-Driven Differentiation

OTL leverages its native PowerPoint environment, making it feel like a seamless part of Office; this creates a perception of professional-grade, presentation-focused tooling.

OTO, being web-based, competes in a crowded space of online project and timeline tools, requiring sharper differentiation; its edge lies in flexibility and independence from the Microsoft ecosystem.

3. Competitive Pressure on OTO

OTO faces intense competition from a range of tools like GanttPro, Preceden, Vizzlo, etc; differentiation must come from unique presentation capabilities, PowerPoint export, or slide-based timeline building presentation tool.

4. Strategic Opportunities

OTL can defend a niche of secure, offline-capable, high-fidelity presentation tools.

OTO can pursue collaborative enhancements and integrations (Google, Teams) to stay competitive and broaden its appeal.

2. Competitor analysis - OTL vs. OTO

Overview of market landscape

OTL operates in a relatively stable, niche market of PowerPoint-based visual planning tools, with fewer direct competitors. Its biggest threat is internal friction (manual install, updates) and slow feature expansion.

OTL should emphasize its “trusted enterprise tool” status — adding enterprise-oriented capabilities.

OTO operates in a crowded and fast-evolving space, competing with GanttPro, Preceden, Vizzlo, and broader PM tools like Asana or Trello (in visualization mode). Here, speed of innovation, integrations, and user experience are critical to win.

OTO should aim to differentiate through unique presentation-first timeline building, while adding just enough PM functionality (collaboration and embed options) to stay competitive in the web-tool space.

2a. Competitor analysis breakdown for OTL

Approach to competitor research for OTL

Since OTL has fewer direct competitors and its biggest threat is internal friction, UX debt and feature parity with its competitors, I analyzed competitors with a focus on features, grouping them by functionality.

2b. Competitor analysis breakdown for OTO

Approach to competitor research for OTO

Competitor analysis for OTO focused more on product positioning and potential future directions because the leadership wanted to gauge its potentiality for growth and analyze OTO’s USP and whether it can cover completely new segments in the productivity market.

3. Market trends for the PM market

Overview of trends for the productivity market (2023-2024)

Intelligent & Integrated Workflows - AI will be embedded into core productivity tools—offering smart automation, contextual suggestions, and predictive assistance. Seamless integration across ecosystems (Google, Microsoft, Slack, etc.) will be essential for user adoption.

Visual, Flexible, and Human-Centered UX - Users expect modular, visual interfaces (timelines, boards, canvases) and consumer-grade experiences, even in B2B. Tools that support scenario planning, storytelling, and intuitive design are leading the way.

Smarter Resource Allocation & Planning - There’s growing demand for tools that simplify team capacity planning, budget tracking, and skills-based allocation. Features like real-time availability views, workload balancing, and AI-powered scheduling help teams work more efficiently and stay aligned.

4. Survey data analysis

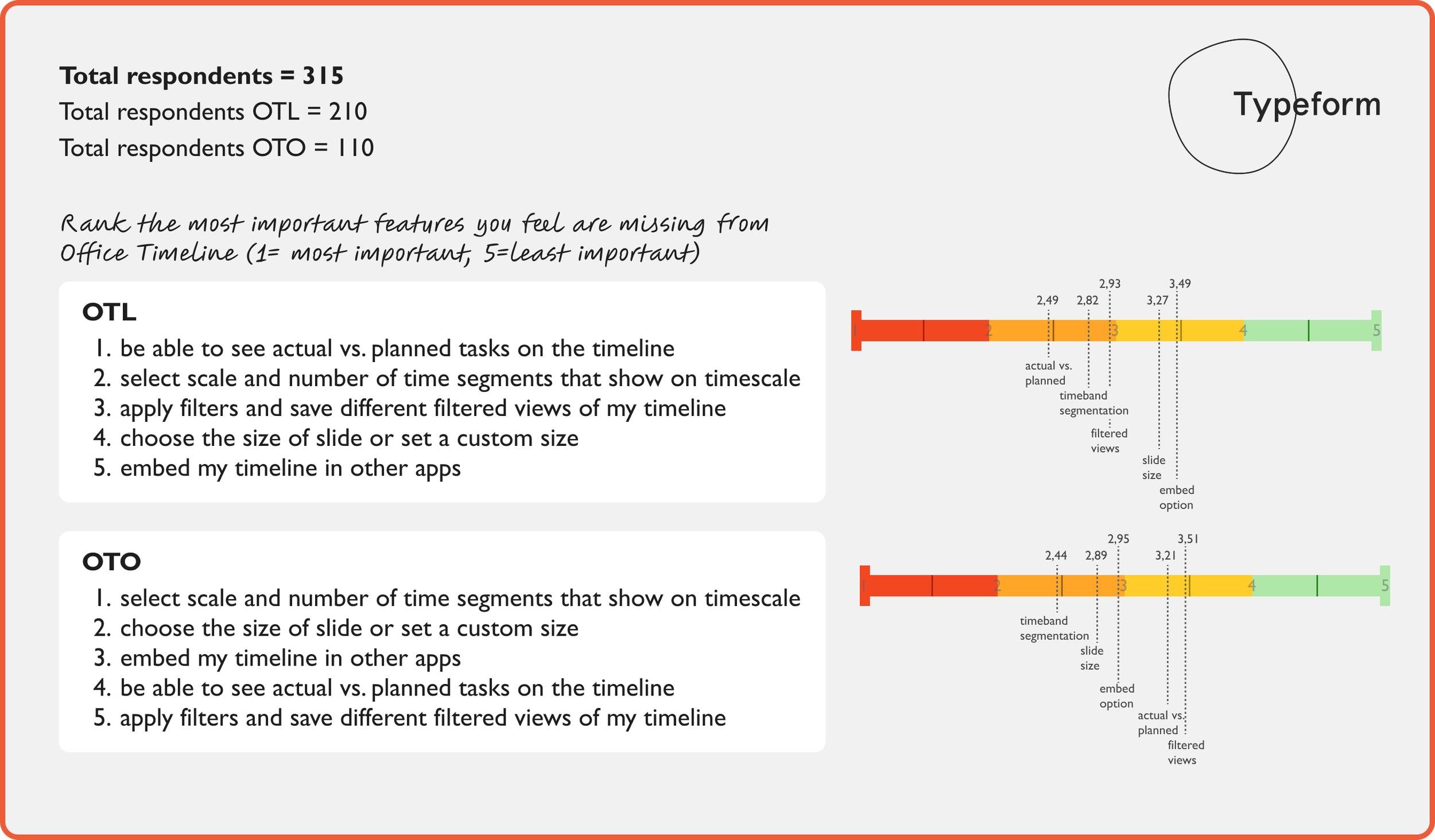

For the goals of this strategic research I compiled a summary of Q3 2023 survey data collected using two platforms: Typeform and Appzi. It explores both predefined-responses and open-ended feedback, and concludes with a comparative analysis of user-reported frictions and desired new features.

4a. Quantitative Survey Results (Predefined Responses)

Typeform Responses: Aggregated results from structured multiple-choice questions. The data reflects user need with regard to features which they consider critical or very important:

OTL users ranked as the most important feature that is missing in the add-in to be able to see actual vs. planned tasks on the timeline; this was followed by enhanced flexibility when it comes to timeband segmentation.

As opposed to OTL users, OTO users chose timeband segmentation as the most important issue, followed by improved customization of slide size/custom size.

Comparing Appzi with Typeform allows assessment of response biases between collection tools.

Appzi Responses for OTO: Similar in structure, offering predefined feedback options.The data reflects user need with regard to missing features which they consider the most important:

In contract to Typeform responses, Appzi data showed actual vs. planned as the most important feature that we should be developing next, followed by customization of slide size/option to choose slide size.

Improved timeband segmentation was ranked third, another significant different from results obtained with Typeform survey.

When comparing validity of responses, I took into consideration the sample size for both survey studies - Typeform & Appzi - which showed a better representation of user population with the Appzi survey.

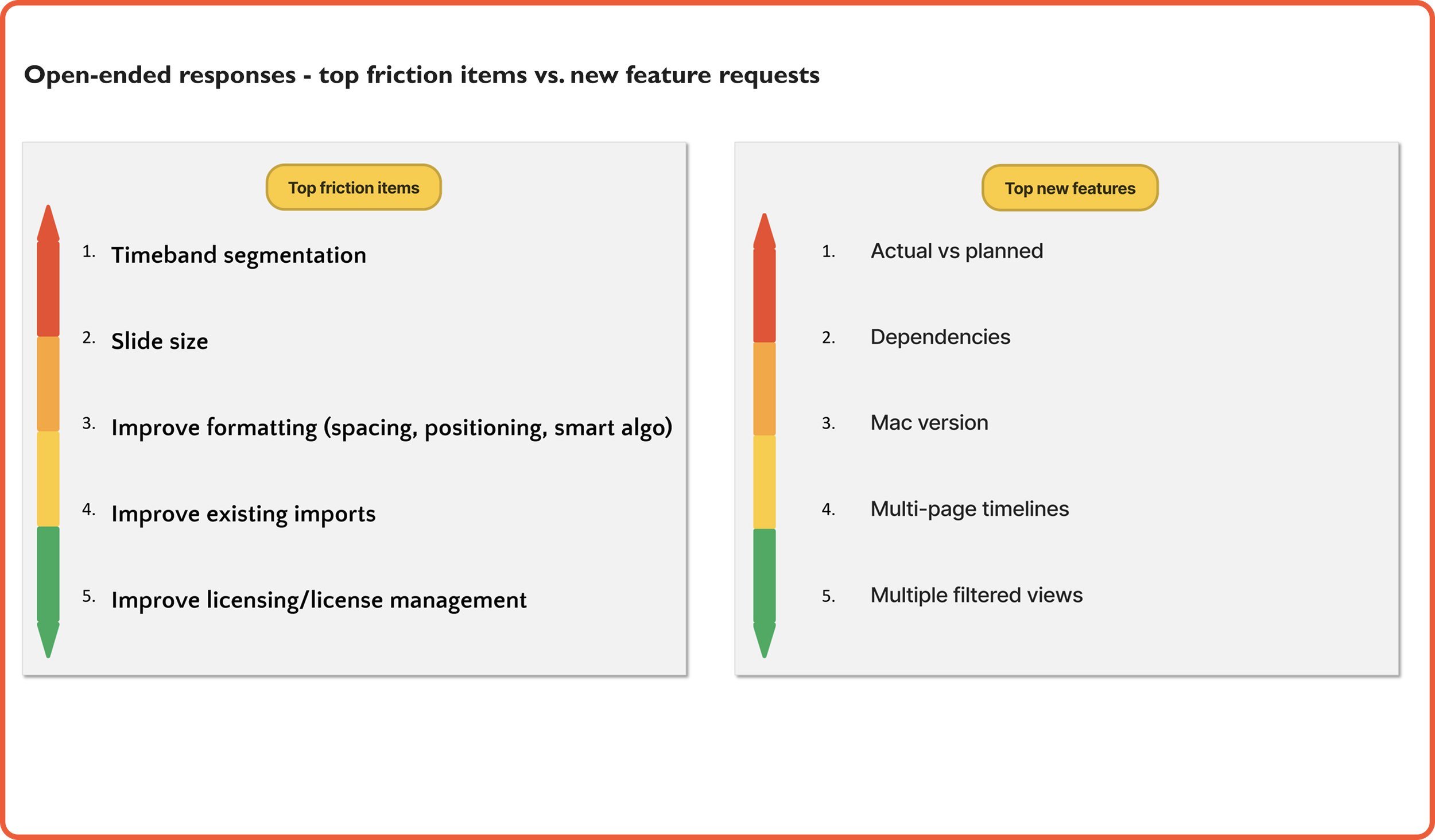

4a. Open-Ended User Feedback (OTO)

Users shared their thoughts without being constrained by predefined answers. This section captures qualitative feedback and emotional tone — essential for understanding hidden issues or feature desires not predicted by survey designers.

Affinity mapping allowed organizing qualitative feedback into themes or categories. Such taxonomy enabled pattern recognition into most commonly mentioned issues or features required:

Dependencies (feature already launched in OTL, but missing in OTO) - dependencies exist when one task's start or completion is linked to another task's start or completion and it is a common feature for timeline creation.

Multi-page timelines - which shows users’ frustration with the slide size, when working with large volumes of data per project.

Flexible, customizable formatting of tasks on the timeline - which reflects users’ need for easy alignments, custom spacing and other friction points that involve a lot of manual work.

Other mentions included: improving existing import flows, managing licenses per organization and a Mac version for presentation software.

Insights from open-ended responses

Users expect feature parity between OTL and OTO - the frequent mention of dependencies - a core timeline functionality already present in OTL - signals user frustration with feature inconsistency between the two products. This reveals a critical user expectation - OTO should not feel like a “lite” version of OTL, especially for users familiar with both.

Slide size limitations are a major friction point - Requests for multi-page timelines and complaints about working with large datasets suggest that current slide constraints hinder usability.

Taken together, these findings show that users are pushing the boundaries of what OTO is currently built for. They are not just creating basic timelines, they are attempting complex project visualizations, at scale, with formatting precision and interdependent logic.

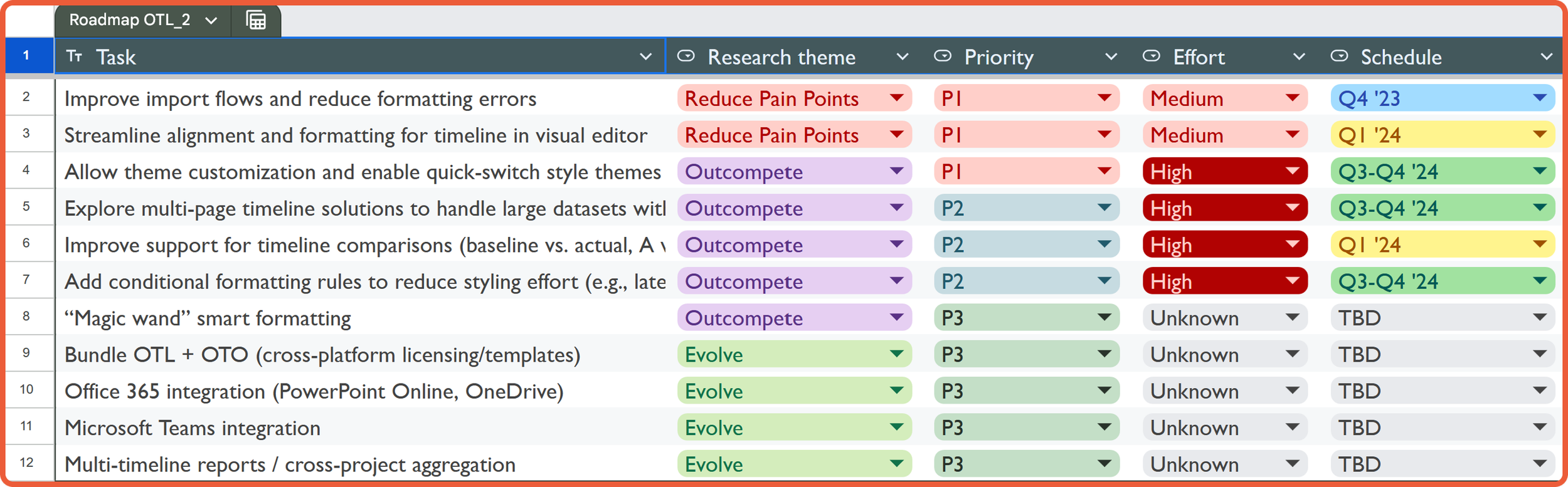

5. Data Triangulation and Product Roadmap

Based on all the findings and insights, I prepared a detailed product roadmap for both Office Timeline Add-in (OTL) and Office Timeline Online (OTO). It was organized by time horizon (short-term vs. long-term) and strategic themes: Reduce Pain Points, Outcompete and Evolve.

These themes were discussed with our CPO, Engineering leads and Line manager, including very high-level estimations regarding effort from a design and technical perspective.

Before road-mapping, I felt the need to review the most important findings in an easy visual manner that allows me to prioritize items during stakeholder meetings.

Items review for OTL

Roadmap items for OTL

Items review for OTO

Roadmap items for OTO

6. Conclusions and study assessment against success criteria

Success Criteria Overview

Quality of Insights: Actionable, pattern-based findings with triangulated validation.

Strategic Impact: Alignment with roadmap and new initiative generation.

Cross-Functional Adoption: Stakeholder buy-in, integration into product planning.

Usability & Communication: Clear problem framing and insight delivery.

Downstream Product Metrics: Improvements in user experience or adoption rates.